Thredd Platform

The Thredd platform provides a comprehensive, robust and reliable solution for card payment processing.

The Thredd platform is integrated within the global payment network and has existing partner relationships and connections that reduces the time required to launch a card program. You can leverage the Thredd payments ecosystem, thus reducing the amount of time-consuming and costly licensing, regulatory compliance, commercial agreements, infrastructure and connections.

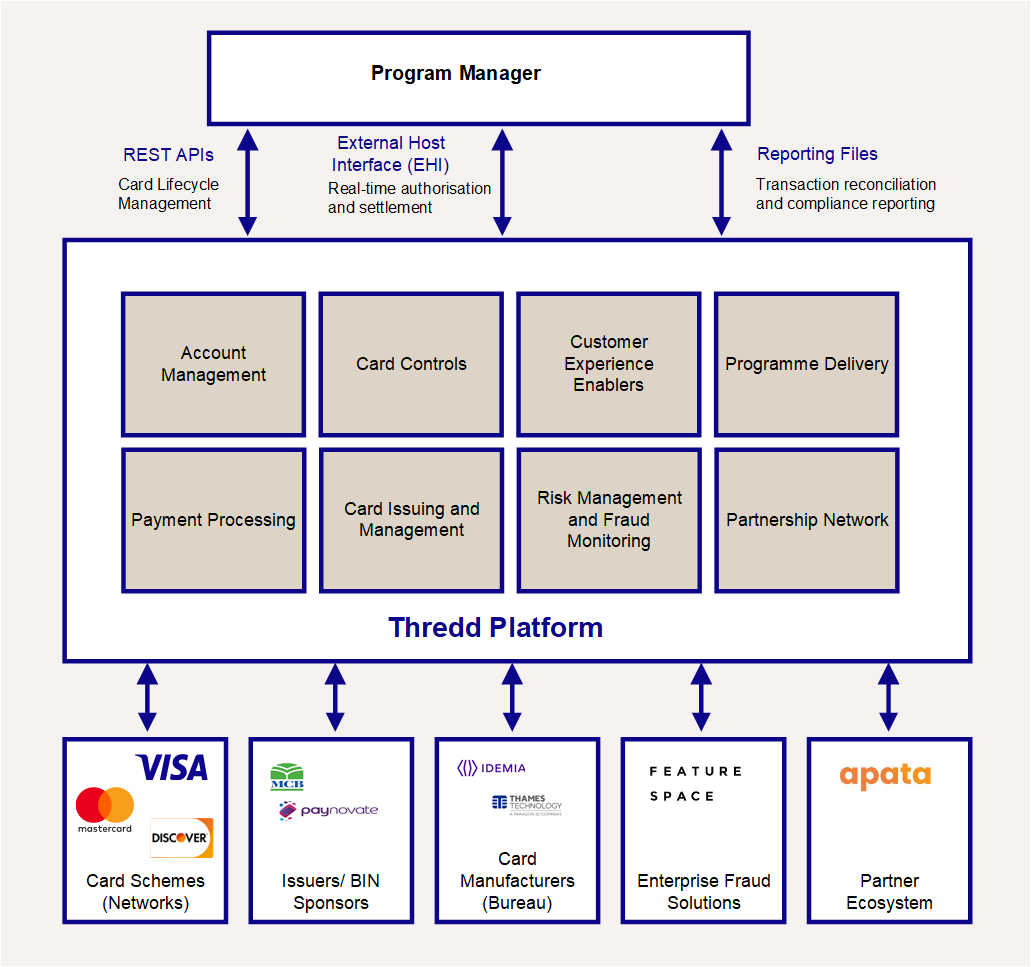

Figure: Thredd Platform and connections

Thredd offers a global service, across Europe, North America, the Middle East and Asia Pacific regions, enabling you to expand your product offering as you grow. Thredd currently supports Visa and Mastercard global payment networks. Our cloud-based processing centres ensure resilience, scalability, reliability and fast processing, in whatever region you are processing.

Card Issuing and Management

Find out about the types of cards Thredd supports and options for issuing cards:

Cardholder Fee Setup and Management

The Thredd Fees module is an optional service that enables you to apply fees to the cards in your program. You can set up fees to charge your cardholders when they use their card. You can also set up recurring fees to take subscription payments.

-

For more information, see the Cardholder Fee Setup and Management.

Card Controls

Card velocity and usage groups enable you to control at a granular level how and where the cards in your program are used.

-

For more information, see: Card Configuration and Controls

Payment Processing

Thredd applies velocity checks related to card number, expiration date, CVV, PIN, transaction limits, fraud checks and others as defined by you, for your card usage scenarios.

Transaction Flow Options

Thredd provides flexible options to enable you to view and respond to payment authorisation requests and financial messages, which are generated when a card is used. The External Host Interface (EHI) is an interface that sends messages to your systems in real-time. Your systems pick up these messages and can respond and process them. Thredd also offer Stand-in Processing (STIP) for scenarios where your systems are unavailable.

-

For more information, see: Transaction Flow Options using EHI

Transaction Reporting

The Thredd system provides a number of daily and weekly reports which can be used to support transaction matching and reconciliation.

-

For more information, see Reporting and Reconciliation.

Card Transaction System (CTS)

The Card Transaction System (CTS) can be used to put through simulation transactions in the Thredd Test environment. The simulation transactions generate transaction authorisation messages and can be used to test your end-to-end integration and message handling.

-

For more information see the Card Transaction System (CTS).

Account Management

Smart Client

Smart Client provides a front-end administrative tool for viewing and managing transactions on the cards in your program. Users can perform actions such as transaction and card queries, card loads and unloads, balance enquiries and adjustments, and view and manage chargebacks.

-

For more information, see Smart Client.

Risk Management and Fraud

Fraud Transaction Monitoring

Fraud Transaction Monitoring (powered by Featurespace) is a fraud solution that minimises online and offline card risk and offers real-time detection of card fraud.

Fraud Transaction Monitoring adapts to new fraud types and identifies unknown threats by detecting unexpected changes (anomalies) in real-time data.

-

For more information, see Fraud Transaction Monitoring.

3D Secure Cardholder Authentication

3D Secure is a program supported by the major card schemes, which provides Cardholder authentication during an online transaction. You will be set up with an account and access to the 3D Secure Portal for configuring your 3D Secure authentication rules.

-

For more information, see Cardholder Authentication.

Payments Dispute Management

Chargebacks are supported via the relevant card scheme (e.g., MasterCard, Visa, or Discover); all schemes provide online systems where issuers and acquirers can view and respond to chargeback notifications. Thredd provides a facility to enable Program Managers to raise and manage chargebacks (Note that this is only available for Mastercard issuers in Europe/UK at present).

-

For more information, see Payments Dispute Management.

Customer Experience Enablers

Cards API Management

You can use the Thredd Web Services or Cards REST API to create and manage the cards in your program.

-

For more information, see Card Management APIs.

Mobile Payments (Tokenisation)

Tokenisation enables cardholders to access mobile wallet functionality — provided by companies such as Apple and Google — which allows payments to be made in store from a smart device such as a smartphone or tokenised device. Tokenisation also helps merchants to improve the security of online payment transactions by replacing the sensitive PAN card details with a token and storing this instead. The token can then be used for repeat or recurring payments.

-

For more information see the Tokenisation Service.

Mobile Text Messaging

The Thredd mobile text messaging (SMS) service enables you to communicate better with your customers and enhance the customer experience by enabling you to send messages to customers’ SMS-enabled devices.

-

For more information, see Mobile Text Messaging (SMS).

Interactive Voice Reponse

The Thredd Interactive Voice Response (IVR) service enables customers to call a phone number to perform various actions for their card.

-

For more information, see Interactive Voice Response (IVR).